In the weeks following the election, President-Elect Biden has talked about forgiving $10,000 of student loan debt as part of a campaign promise to ease the burden on borrowers of student loans. Key to any policy roll-out is the success of its technical implementation and digital delivery. A failed website launch or underdeveloped digital strategy can imperil even the largest policy efforts.

It’s critical to consider as a first-class concern the delivery of digital services in the implementation of any modern policy initiative. There is a lightweight way that the new administration could start to achieve its goals around student loan relief, with a modest and timely investment in a digital service to engage with borrowers directly and to facilitate the implementation on the government side.

What’s needed is a simple, purpose-built website to help borrowers apply for loan forgiveness, and help them stay enrolled in payment programs. This site could be built and delivered quickly using existing assets as building blocks, speeding relief to millions of borrowers.

Make applying for loan forgiveness fast and easy

Studies have shown that for those most at risk of default, the forgiveness of $10,000 of debt would eliminate the entire burden for nearly a third of borrowers and provide substantial relief to many more. For this reason, the government should make applying for forgiveness as simple a process as possible.

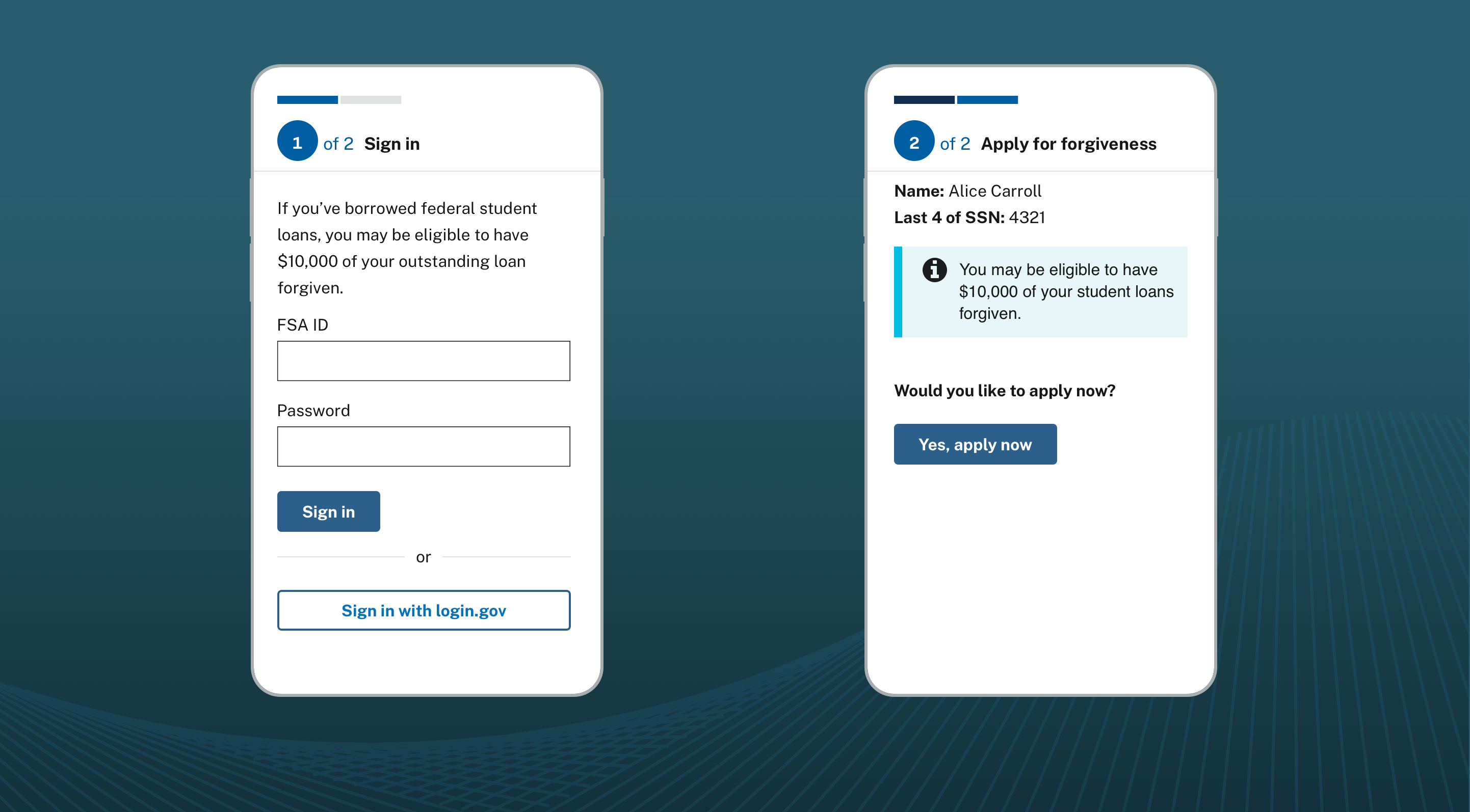

Instead of a lengthy form, ED could create a two-step process to apply: prove your identity, then click a single button to send your application. ED could use the existing FSA ID system or login.gov to give users a simple, secure way to prove their identity, which ED could reference against the information it already has about borrowers. Then, with a click of a button, borrowers could send their application to ED, where it would be recorded in a backend database. This could be any system of record the Department of Education prefers or an intermediate database that interfaces with a legacy system.

Borrowers will want to know the status of a forgiveness application as it is processed. The site could notify borrowers via channels they prefer, such as email or SMS, when the application’s status changes as it is processed on the backend, or allow them to log back in to the site and see the status there.

One step further: Modernize an existing program to reduce defaults

If the Biden Administration wanted to go a step further to ease the burden on borrowers of student loans, they could integrate an existing program called income-driven repayment (IDR) plans into the forgiveness application process. IDR plans make monthly payments affordable by indexing them to the borrower’s income. Payments are typically capped at 10-20% of the borrower’s take-home discretionary pay. Borrowers are required to recertify their income with the government each year, but unfortunately, more than half fail to do so. They are then penalized with additional interest and larger monthly payments, leading many to default.

The government used to make this easier on borrowers. Borrowers could fill out a short 1-page form, OMB form 1845-0017, that authorized the IRS to share just their income with the Department of Education for the purpose of recertifying their income for a period of several years. This simple cross-governmental information system was intended to address this problem of accidentally losing enrollment in the program. Unfortunately, the government eliminated the form in 2012. There has been an MOU between the IRS and the Department of Education since 2017 regarding re-establishing this information sharing pipeline, but progress has stalled.

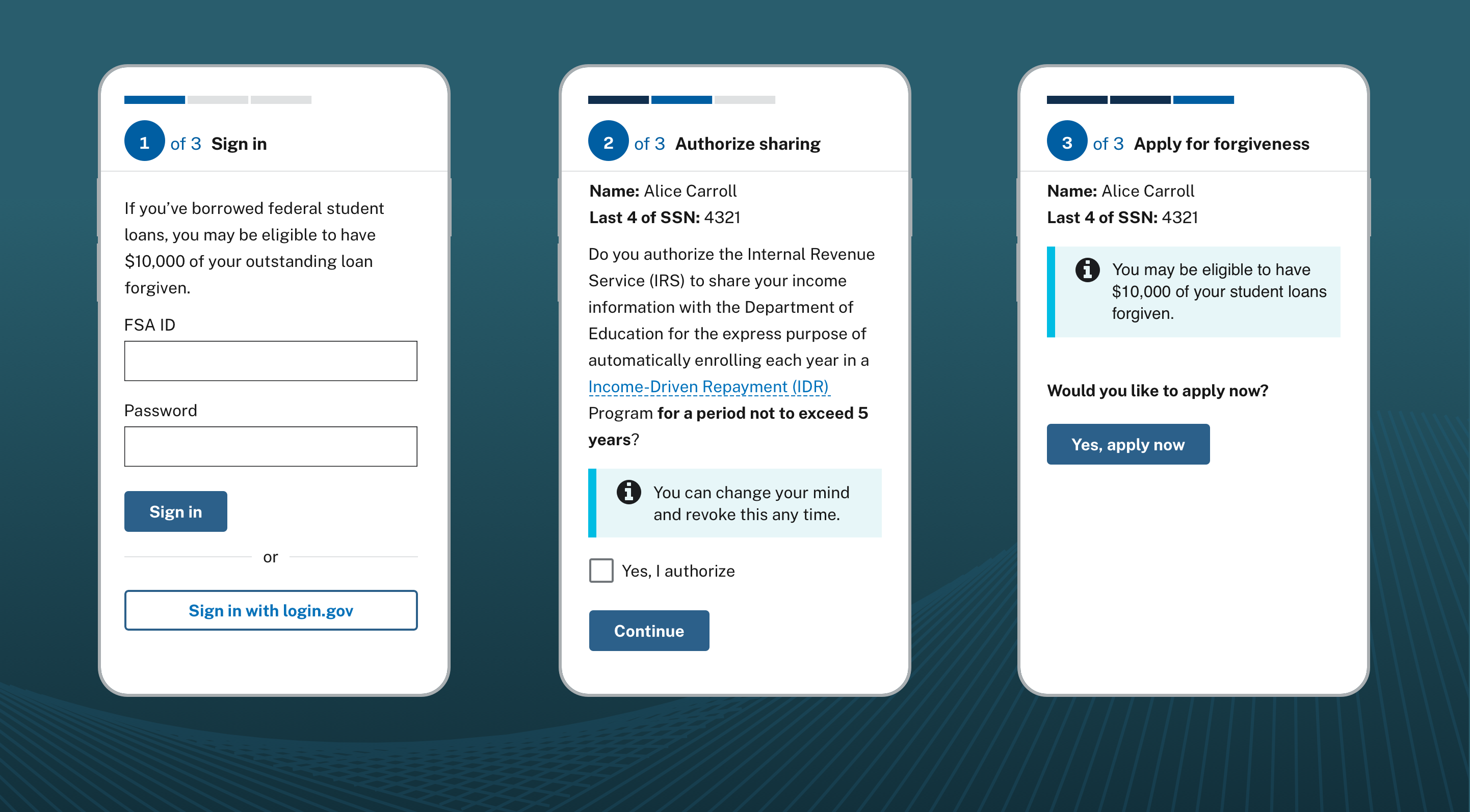

The new administration could revive the idea of the original form as a modern digital service, and update it to be a streamlined, easy-to-understand, and easy-to-update tool for borrowers to authorize the data sharing and see their status in the program. Here’s a mockup of what a simple site could look like for users to prove their identity, authorize the IRS and ED to share information, and send their loan forgiveness application to ED.

Borrowers would still log in with login.gov or their FSA ID. Then, they’d be presented with a website that gave them the ability to click a button to authorize the sharing of income information between the two agencies for a period of time, for example, up to 5 years. Once authorized, the borrower could return to the site to see the current status of that authorization and to revoke their consent if they so choose.

For ease of discovery and implementation, it makes the most sense to host this site with studentaid.gov. The authorization request could go into any backend processing system that makes the most sense for the Department of Education and IRS systems to consume, such as Salesforce or a custom API layer.

The form, like this mockup, could be designed using the U.S. Web Design System to ensure it’s responsive, accessible, and has an experience users can trust. Designers would need to conduct additional user research with borrowers of student loans to ensure the form meets their needs and has the proper amount of information to instill trust in the IDR and loan forgiveness process. It would also be important that the ED plan for demand to ensure the website stays available and backend processes are able to handle a sudden increase in requests for loan forgiveness and enrollment in IDR plans.

The requirement for annual recertification of income for IDR plans presents an obstacle to borrowers and creates administrative overhead as borrowers drop in and out of the program. Automating and streamlining the recertification process by providing borrowers a modern tool to enable agencies to share the data they already have reduces the risk of additional costs and financial hardship for borrowers. A modern digital service will both help keep borrowers in the program and attract and enroll new ones, boosting participation and delivering widespread financial assistance to millions of households.

The new administration can quickly deliver substantial assistance and relief to borrowers of student loans through a simple form that combines loan forgiveness and IDR plans. By using digital services built with agility and taking advantage of existing technical infrastructure, such services need not be challenging, lengthy procurements with risky delivery profiles. Instead, a digital service that is procured well, designed for users, and delivered ready for scale can be a deciding factor in successfully implementing this policy proposal.

Application designs by Scott Weber