Expanding equality through accessible data

Agency

Consumer Financial Protection Bureau (CFPB)

The Consumer Financial Protection Bureau (CFPB) has embarked on a multiyear effort to develop an open and transparent code base and APIs for the collection and publication of Home Mortgage Disclosure Act (HMDA) data (HMDA Platform).

To improve data submission and publication, CFPB asked vendors to participate in a one-week Innovation Tech Sprint Program. Ad Hoc’s team brought our experience and best practices in creating exceptional developer experiences from our work on Blue Button 2.0, Beneficiary Claims Data API, CMS Dev Portal, and VA Lighthouse API to present recommendations to the CFPB.

The challenge

The information in CFPB’s HMDA platform plays a critical role in combating inequality and inequity in home loans. People can use HMDA data to identify possible discriminatory lending patterns in mortgage lending and help the public assess how financial institutions are serving the housing needs of their local communities. CFPB wanted to make it easier for people to see why or how they could use the HMDA API and data.

What we did

During the one week Tech Sprint, the Ad Hoc team used its design sprint cadence and Learn, Build, Measure approach to quickly identify, understand, and test solutions to our problem statement.

Our hypothesis

Treating API users like end users would help expand access and use of HMDA data.

We used our experience working with CMS and VA APIs to develop a research plan to better learn about the needs of people who might use this data to support investigations (such as journalists, banks, and court clerks) and in academic settings. We also conducted competitive analysis of commercial API platforms that provide good user understanding and user experience. We used our findings to establish a set of action-oriented principles that guided our work:

Use plain, verb-oriented language

Verb-oriented language helps people understand where and how they complete the task at hand. Defining

acronyms and changing program-specific language supports a broader audience.

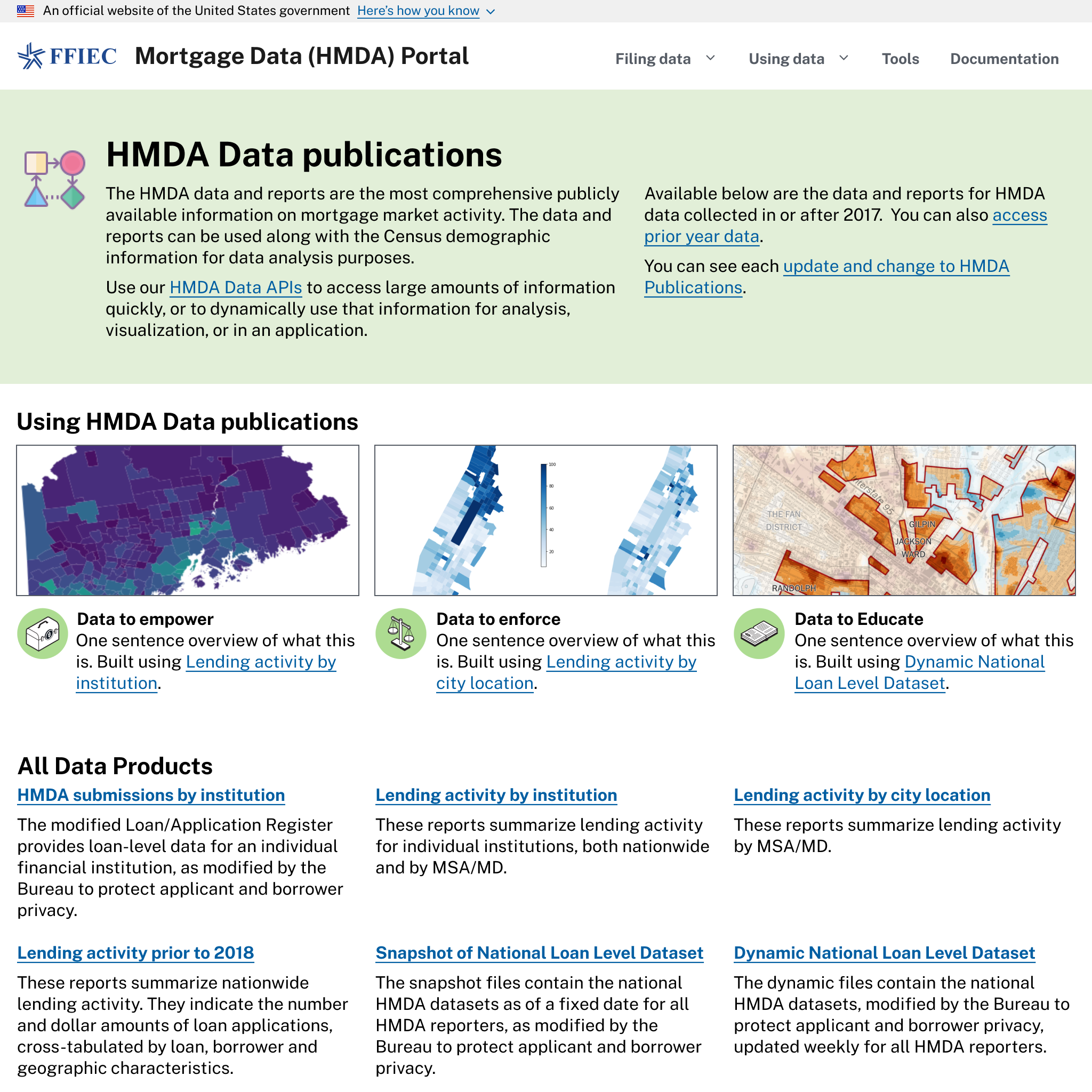

Illustrate the value

Use examples and scenarios to show people how they can use different data sets to achieve their goals.

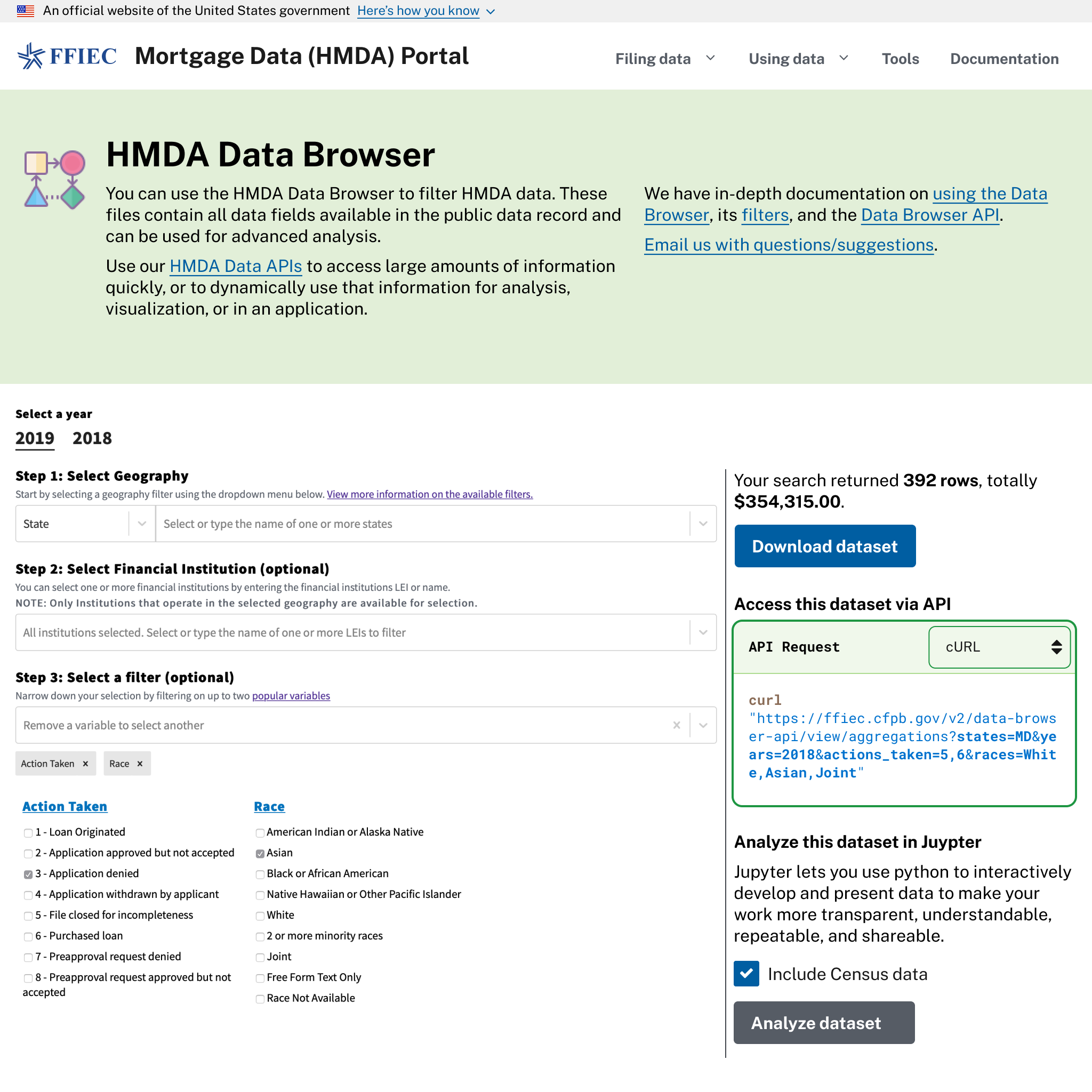

Showcase the API

Bridge the gap between a person’s need and how the API supports it.

Use data right away

Use technology to remove the burden using HMDA data.

We applied those principles to build prototypes, content recommendations, and a long-term research plan CFPB could use to create an effective developer experience that expanded access and use of HMDA data.

Outcomes

We tested our prototypes with Ad Hoc team members representative of our target audience. They were able to describe how they might use HMDA data and what actions they’d take to use the API. These prototypes, along with our content recommendations and long-term research plan, provided a roadmap for CFPB to continue exploring ways to make accessing HMDA data easier.

Short, focused design sprints like this allow Ad Hoc to help agencies quickly explore problems and develop paths forward that are backed by research. These low risk, low investment activities can help teams chart a path to improved user experiences and more modern government digital services.

Award for Effectiveness & Impact

We were honored with this award given to the team who presented practical and concrete improvements that added value for HMDA stakeholders and users.