With existing tools, the IRS could connect people with healthcare

What if HealthCare.gov’s Open Enrollment always overlapped with IRS’s tax submission window? This post explores how these agencies could work across their org charts, using the digital infrastructure and information they have today to help millions of tax filers find affordable or free healthcare, thereby reducing the number of uninsured people in America.

HealthCare.gov’s digital infrastructure

HealthCare.gov represents an early example of an effective government digital service iterating its ability and capabilities to promote economic growth and people’s health. Since its inception, HealthCare.gov’s Data Services Hub has connected the Federally Facilitated Exchange (FFE) with state services and exchanges, other federal agencies like IRS, insurance providers, and now third-party enrollment experiences through the Enhanced Direct Enrollment (EDE) program. HealthCare.gov also provides Marketplace API, an openly-available source of Affordable Care Act (ACA) plan information and basic business rules around eligibility and coverage.

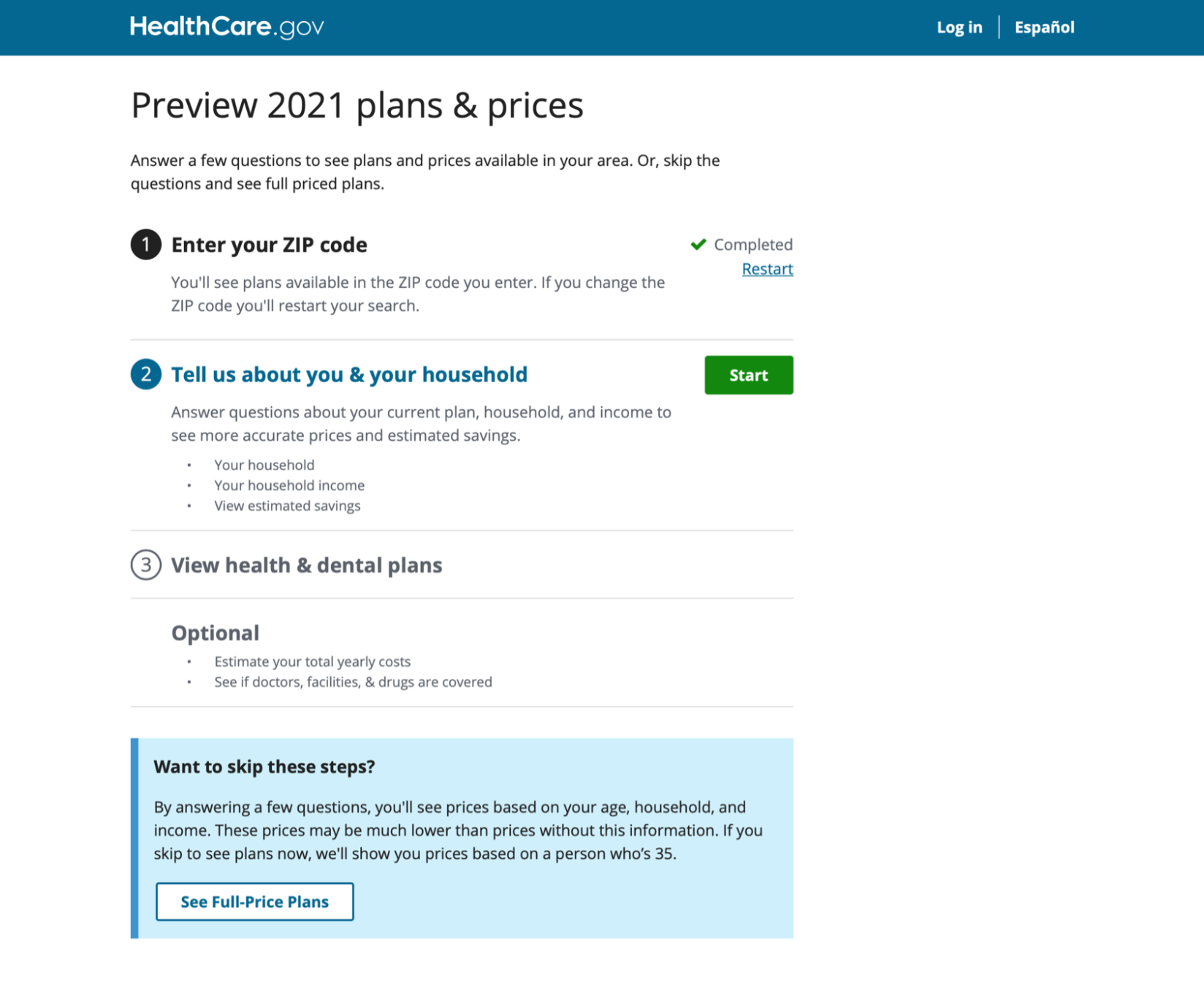

HealthCare.gov’s window shopping tool walks people through a streamlined experience to collect basic information about themselves, their household, and income.

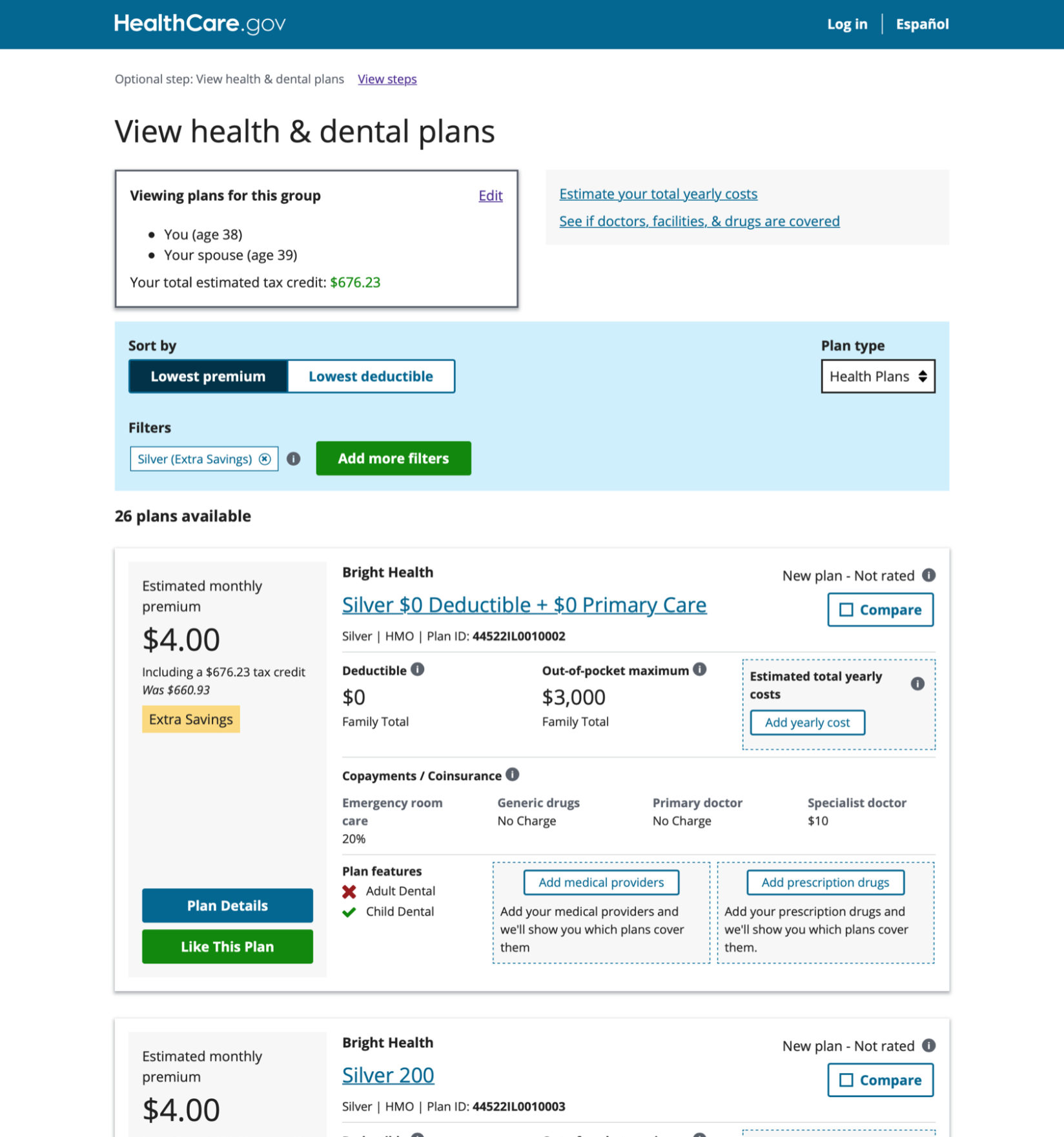

The tool then uses this information to receive an estimated eligibility determination from Marketplace API, along with tax credit eligibility and insurance premium cost. People can use this information to explore insurance coverage options that best meet their health needs before going through the application and purchasing process.

IRS and tax vendors could capitalize on CMS’ investment in digital infrastructure, using these same tools to present a cohesive government services experience, and help reduce the number of uninsured people in America.

Taxes and ACA eligibility

The information used when submitting taxes contains all of the information needed by Marketplace API to estimate eligibility, insurance premiums, and even start an application for ACA based coverage.

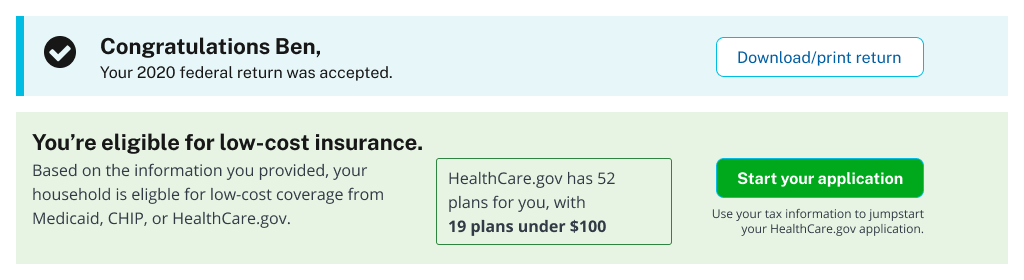

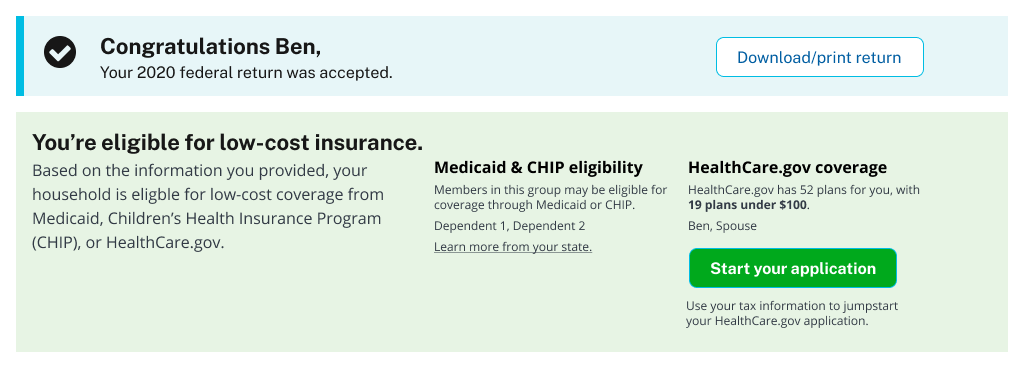

Many tax vendors already use Marketplace API today. Using Marketplace API’s Eligibility Estimates endpoint, vendors could use collected tax information to alert filers of their eligibility for low-cost coverage from HealthCare.gov or state programs like Medicaid and CHIP.

The same household information used to estimate eligibility can also return information about average premiums, out of pocket costs, and quality ratings for available insurance plans. Marketplace API’s Plan Search Stats endpoint could show tax filers how low premiums are, highlighting the fact that nearly 46% of the uninsured population could receive free or nearly free coverage through Medicaid or zero-premium ACA plans.

141 million tax returns were submitted in 2019, 90% electronically. CMS and IRS could work together to reach this large audience with very little cost compared to the costs of marketing and outreach needed to reach that same number of people.

EDE program members have access to API endpoints that connect to eligibility and enrollment services within HealthCare.gov. IRS and tax vendors could use these same APIs to create an application using information collected during the tax preparation process. By removing duplicate content entry, IRS and CMS would make applying for coverage easier, reduce the time people needed to apply for coverage, and reduce auditing and verification costs around the typically difficult process of determining income when applying.

Invest in infrastructure for effective digital services

As the world emerges from the pandemic, America has an opportunity to invest in and improve the digital infrastructure underlying the services it provides. The federal government needs to look beyond the org chart of branches, agencies, and offices and instead adapt policies and technologies to most effectively meet the needs and expectations of the people they serve. With that clear direction and strong leadership, the federal government has many opportunities for cross-agency collaboration using simple technical solutions like APIs to expand access to services, respond to change, and ultimately better meet the needs of the people they serve.

Related posts

- Prototyping a COVID-19 vaccination verification app

- Prototyping a COVID-19 vaccination verification app

- Ad Hoc, Fearless, and Ellumen win contract to continue support of Blue Button 2.0

- Modernizing how Medicare beneficiaries find and enroll in coverage

- The 21st Century IDEA Act Playbook Part 3: Customized, mobile-friendly experiences

- The 21st Century IDEA Act Playbook Part 2: Search, security, and serving users